3QFY2019 Result Update | Media

January 31, 2019

Music Broadcast

BUY

CMP

`293

Performance Update

Target Price

`475

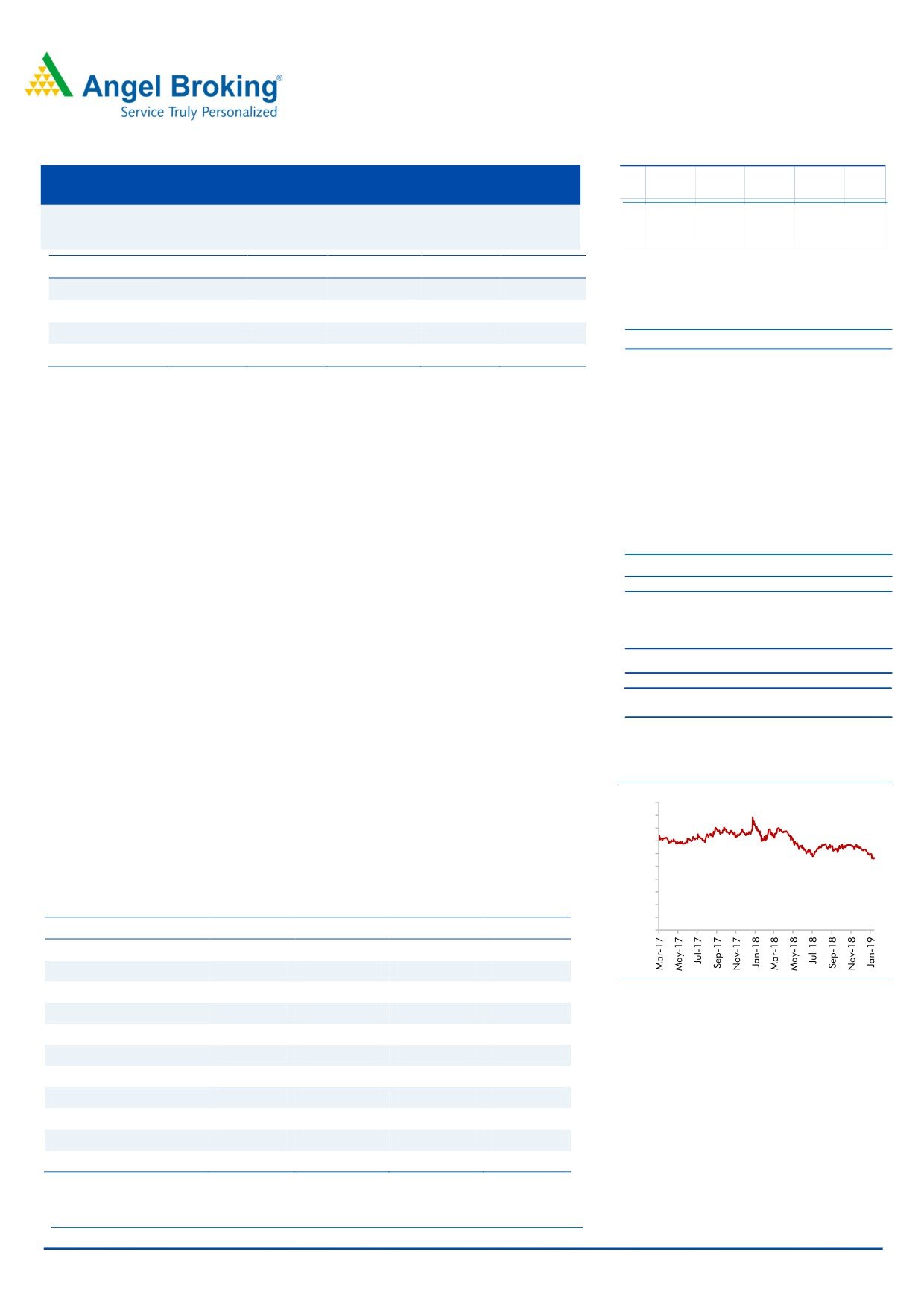

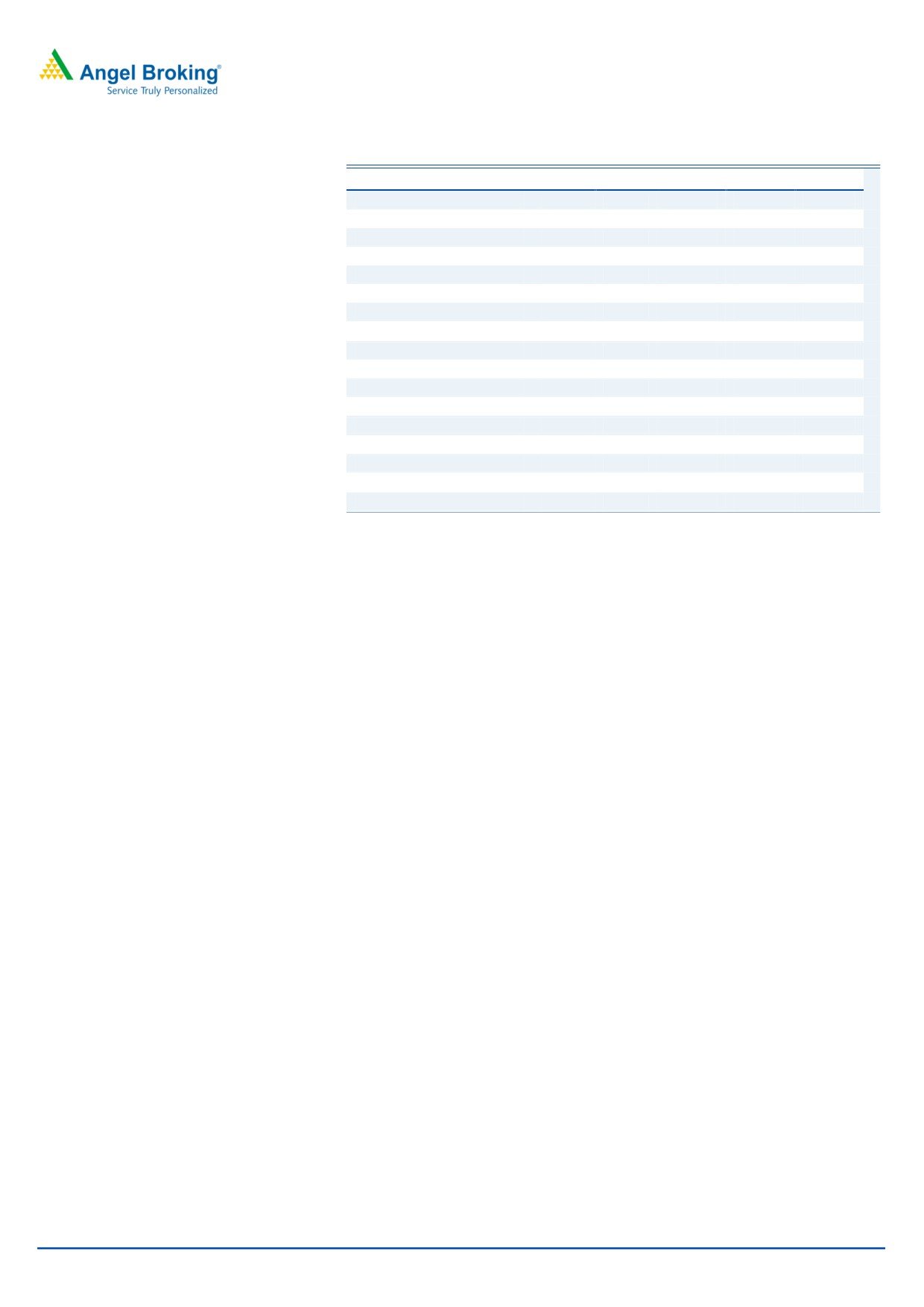

Y/E March (` cr)

3QFY19

3QFY18

% yoy

2QFY19

% qoq

Investment Period

12 month

Net sales

87

76

14.2

80

8.6

EBITDA

29

23

22.6

27

7.7

EBITDA margin (%)

32.9

30.6

225bp

33.1

(28bp)

Stock Info

Adjusted PAT

16

12

37.9

13

22.4

Sector

Media

Source: Company, Angel Research

Market Cap (Rs cr)

1,600

Net Debt

(182)

For 3QFY2019, Music Broadcast (MBL) posted in-line with expectation results both

Beta

0.9

on top-line and bottom-line fronts. Revenues grew by ~14% yoy to `87cr on the

52 Week High / Low

408/267

back of price hike. The company’s operating margins improved by robust 225bps

Avg. Daily Volume

2,655

yoy. On the bottom-line front, MBL reported lower growth of ~38% yoy to `16cr

Face Value (Rs)

10

on the back of higher taxes during the quarter.

BSE Sensex

36,253

Nifty

10,829

Top-line grew ~14% yoy: MBL’s top-line grew by ~14% yoy to `87cr on the back

Reuters Code

MUSI.NS

of 11% ad rate hikes in legacy stations and improvement in utilization levels of 11

Bloomberg Code

RADIOCIT@IN

new stations. Going forward, we expect strong growth on top-line and bottom-

line fronts owing to elections.

Shareholding Pattern (%)

Promoters

73.7

Strong operating performance aids profitability: On the operating front, the

MF / Banks / Indian Fls

8.3

FII / NRIs / OCBs

2.4

company reported better margins, up 225bps yoy at 32.9% due improvement in

Indian Public / Others

15.6

utilization. On the bottom-line front, MBL reported growth of ~38% yoy to `16cr

on the back of higher revenue growth and better margin improvement during the

Abs. (%)

3m 1yr

3yr

Sensex

5.0

(1.2)

43.4

quarter.

MBL

(14.0)

(25.4)

NA

Outlook and Valuation: We expect MBL to report net revenue CAGR of ~11% to

~`370cr over FY2018-20E mainly due to increase in advertising rates and

improvement in utilization of new radio stations. Further, on the bottom-line front,

Historical share price chart

we expect CAGR of ~18% to`72cr over the same period on the back of better

500

margins. Moreover, considering sustainable growth opportunities over the next 5-

450

400

7 years, most of the capex already through and strong parentage, we have a

350

positive outlook on the company. Thus, we maintain our Buy recommendation on

300

250

MBL with Target Price of `475.

200

150

100

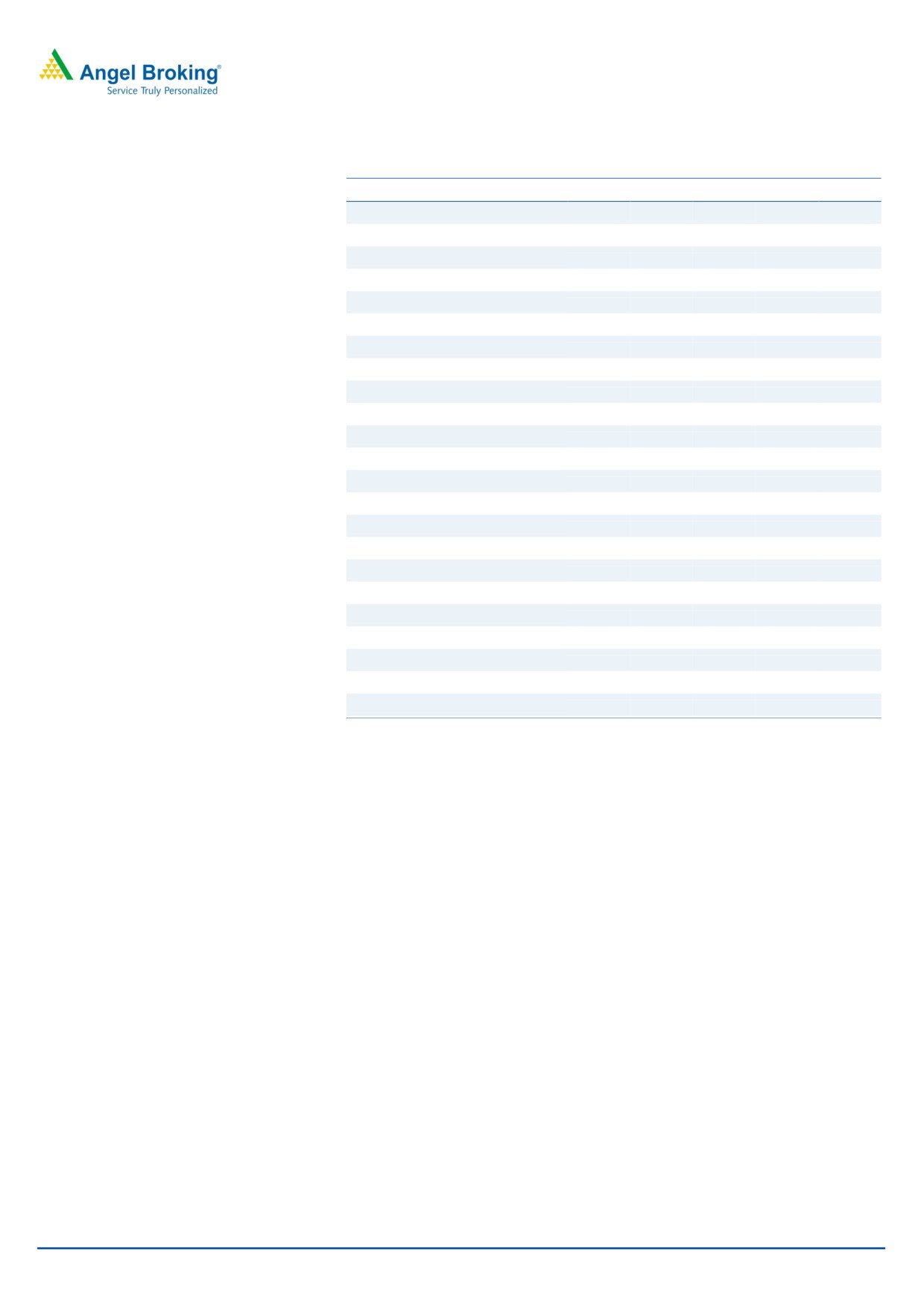

Key Financials

50

Y/E March (` cr)

FY2017

FY2018

FY2019E

FY2020E

0

Net sales

271

298

331

370

% chg

20.4

9.9

10.9

12.0

Adj. Net profit

36

52

62

72

Source: Company, Angel Research

% chg

30.3

45.4

20.6

15.7

EBITDA margin (%)

33.6

32.6

34.1

34.8

EPS (`)

6.2

9.1

10.9

12.6

Research Analyst

P/E (x)

47.0

32.3

26.8

23.2

Amarjeet S Maurya

P/BV (x)

3.0

2.8

2.6

2.4

RoE (%)

6.5

8.6

9.6

10.2

022-40003600 Ext: 6831

RoCE (%)

10.1

10.9

12.6

13.8

EV/EBITDA (x)

15.3

14.4

12.4

10.9

Source: Company, Angel Research Note

Please refer to important disclosures at the end of this report

1

Music Broadcast Ltd| 3QFY2019 Result Update

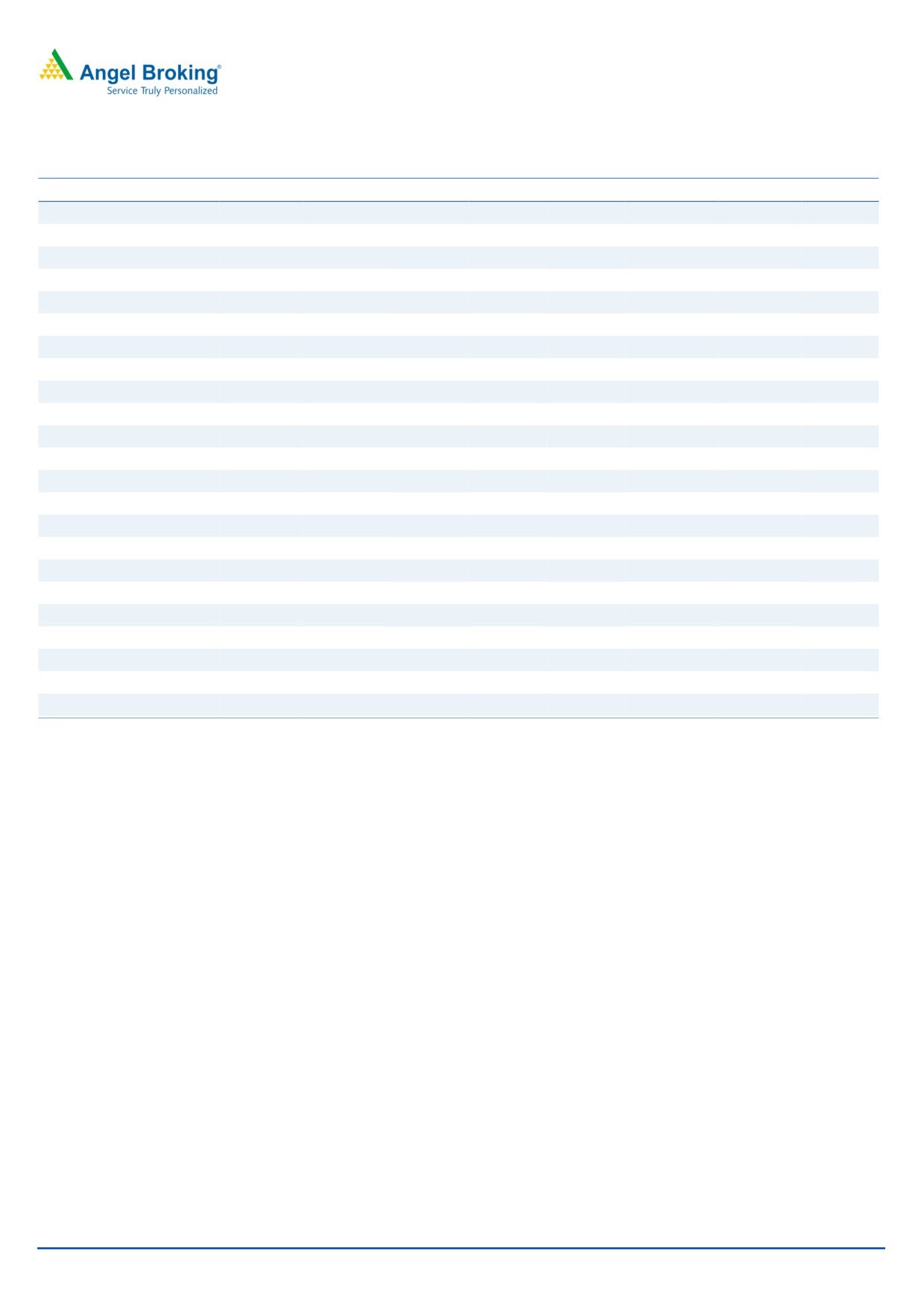

Exhibit 1: 3QFY2019 Performance

Y/E March (` cr)

3QFY19

3QFY18

% yoy

2QFY19

% qoq

9MFY19

9MFY18

% chg

Net Sales

87

76

14.2

80

8.6

243

222

9.2

Staff Costs

17

18

(5.0)

18

(6.6)

53

52

1.5

(% of Sales)

19.2

23.1

22.3

21.7

23.3

Other Expenses

42

35

18.3

36

16.9

109

101

8.2

(% of Sales)

47.9

46.3

44.5

44.9

45.3

Total Expenditure

58

53

10.5

54

9.0

162

153

5.9

Operating Profit

29

23

22.6

27

7.7

81

70

16.5

OPM

32.9

30.6

33.1

33.4

31.4

Interest

1

4

(65.1)

1

(0.7)

4.1

11.6

(64.5)

Depreciation

7

7

3.5

7

0.9

20

20

3.1

Other Income

4

4

3.0

4

23.9

10.5

14.0

(25.0)

PBT (excl. Ext Items)

25

17

44.9

22

12.9

67

53

28.3

Ext (Income)/Expense

-

-

-

-

-

PBT (incl. Ext Items)

25

17

44.9

22

12.9

67

53

28.3

(% of Sales)

28.6

22.6

27.6

27.7

23.6

Provision for Taxation

9

5

60.7

9

(1.7)

24

17

41.5

(% of PBT)

34.3

30.9

39.4

35.8

32.5

Reported PAT

16

12

37.9

13

22.4

43

35

22.0

PATM

18.8

15.6

16.7

17.8

15.9

Minority Interest After NP

Reported PAT

16

12

37.9

13

22.4

43

35

22.0

Equity shares (cr)

6

6

6

6

6

FDEPS (Rs)

2.9

2.1

37.9

2.3

22.4

7.6

6.2

22.0

Source: Company, Angel Research

January 31, 2019

2

Music Broadcast Ltd| 3QFY2019 Result Update

Outlook and Valuation: We expect MBL to report net revenue CAGR of ~11% to

~`370cr over FY2018-20E mainly due to increase in advertising rates and

improvement in utilization of new radio stations. Further, on the bottom-line front,

we expect CAGR of ~18% to`72cr over the same period on the back of better

margins. Moreover, considering sustainable growth opportunities over the next 5-7

years, most of the capex already through and strong parentage, we have a positive

outlook on the company. Thus, we maintain our Buy recommendation on MBL with

Target Price of `475.

Downside risks to our estimates

Slowdown in Indian economy would impact overall ad spends: A slowdown in the

economy could affect spending from the clients, which in turn would affect the

company’s overall earnings.

Increase in content price: Inability to effectively source music content from third

party music production entities/associations can increase the input costs for the

company, and hence, may result in the dip in margins.

Reduction in listenership numbers: Rising acceptance of data and continuous

reduction in the cost of data could lead to shift of listenership to digital

platform/mobile applications (Hungama, Saavn, Gaana) and options to download

could risk the listenership in Metros and key towns initially.

Company Background

Music Broadcast Limited (MBL) owns and operates FM radio stations under the

brand names Radio City and Radio Mantra. The company has 39 radio stations

and operates its radio stations in 37 Indian cities. Radio City is present in 12 out of

the top 15 cities in India by population. Radio City has been ranked Number One

in Mumbai, Bengaluru and Delhi in terms of number of listeners and has a total

number of 49.60mn listeners across all 23 cities (according to AZ Research). Music

Broadcast Limited operates as a subsidiary of Jagran Prakashan Limited. It also

operates 40 Web radio stations that offer Internet radio with live RJ hosted shows

through Planet Radio City in 8 languages. In addition, Music Broadcast Limited

operates 'Planet Radio City' mobile app that plays various stations such as 'Radio

City Freedom', 'Radio City Electronica', 'Radio City Metal', and 'Radio City Smaran'

in various languages on mobile and other smart devices.

January 31, 2019

3

Music Broadcast Ltd| 3QFY2019 Result Update

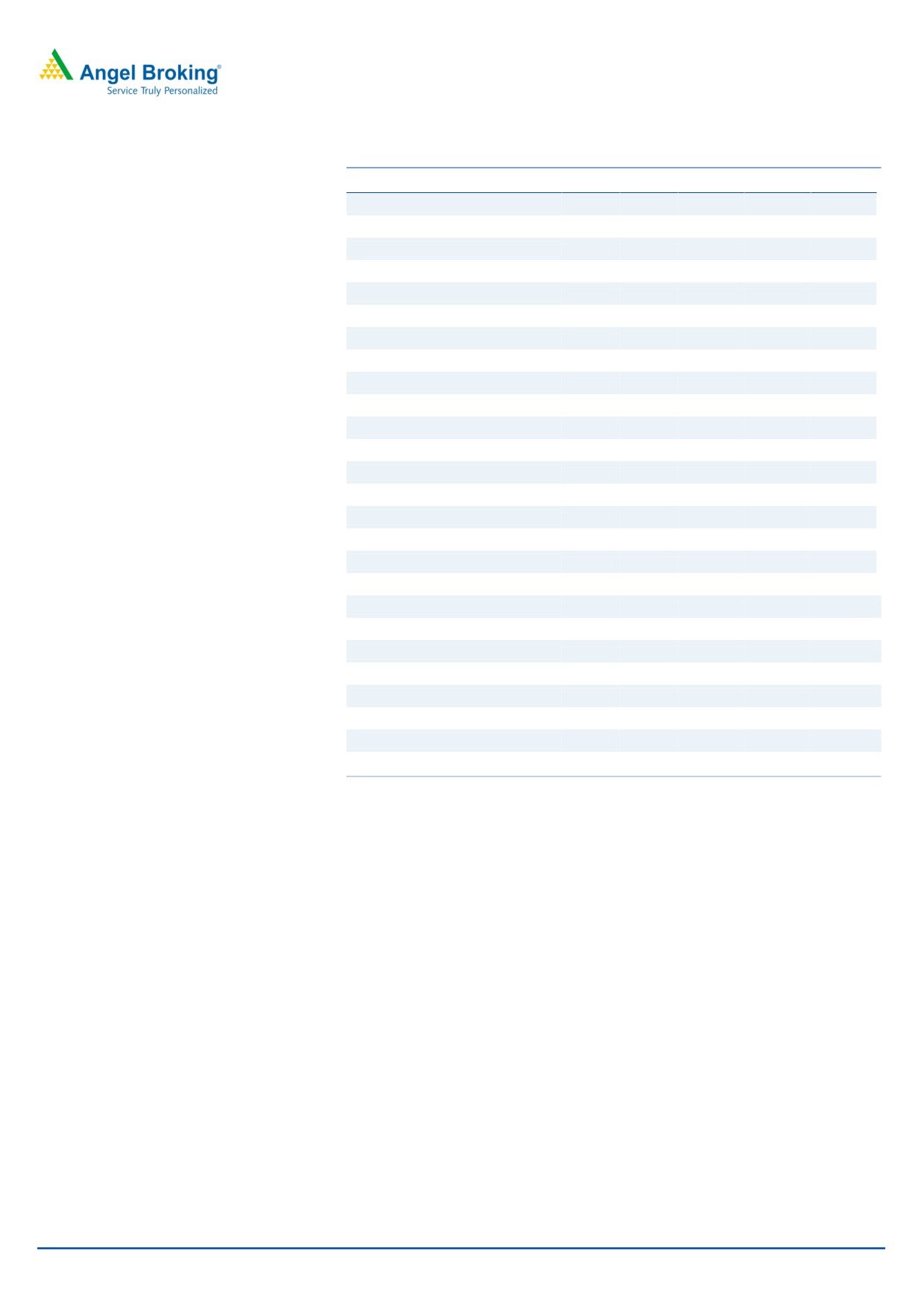

Profit & Loss Statement

Y/E March (` cr)

FY2016

FY2017

FY2018

FY2019E

FY2020E

Total operating income

225

271

298

331

370

% chg

12.3

20.4

9.9

10.9

12.0

Total Expenditure

147

180

201

218

242

License fees

17

19

21

23

26

Personnel

51

65

69

75

84

Others Expenses

79

96

111

119

131

EBITDA

78

91

97

113

129

% chg

25.4

16.8

6.4

16.2

14.3

(% of Net Sales)

34.7

33.6

32.6

34.1

34.8

Depreciation& Amortisation

17

20

26

27

28

EBIT

61

72

71

86

100

% chg

31.8

16.5

(1.1)

21.3

17.1

(% of Net Sales)

27.2

26.4

23.7

26.0

27.1

Interest & other Charges

21

19

15

5

5

Other Income

15

4

19

12

12

(% of PBT)

27

8

26

13

11

Extraordinary Items

0

1

-

-

-

Share in profit of Associates

Recurring PBT

56

57

75

93

108

% chg

17.9

2.7

31.9

23.7

15.7

Tax

14

20

24

31

36

PAT (reported)

27

36

52

62

72

% chg

(42.0)

30.3

45.4

20.6

15.7

(% of Net Sales)

12.1

13.1

17.3

18.8

19.5

Basic & Fully Diluted EPS (Rs)

4.8

6.2

9.1

10.9

12.6

% chg

(42.0)

30.3

45.4

20.6

15.7

January 31, 2019

4

Music Broadcast Ltd| 3QFY2019 Result Update

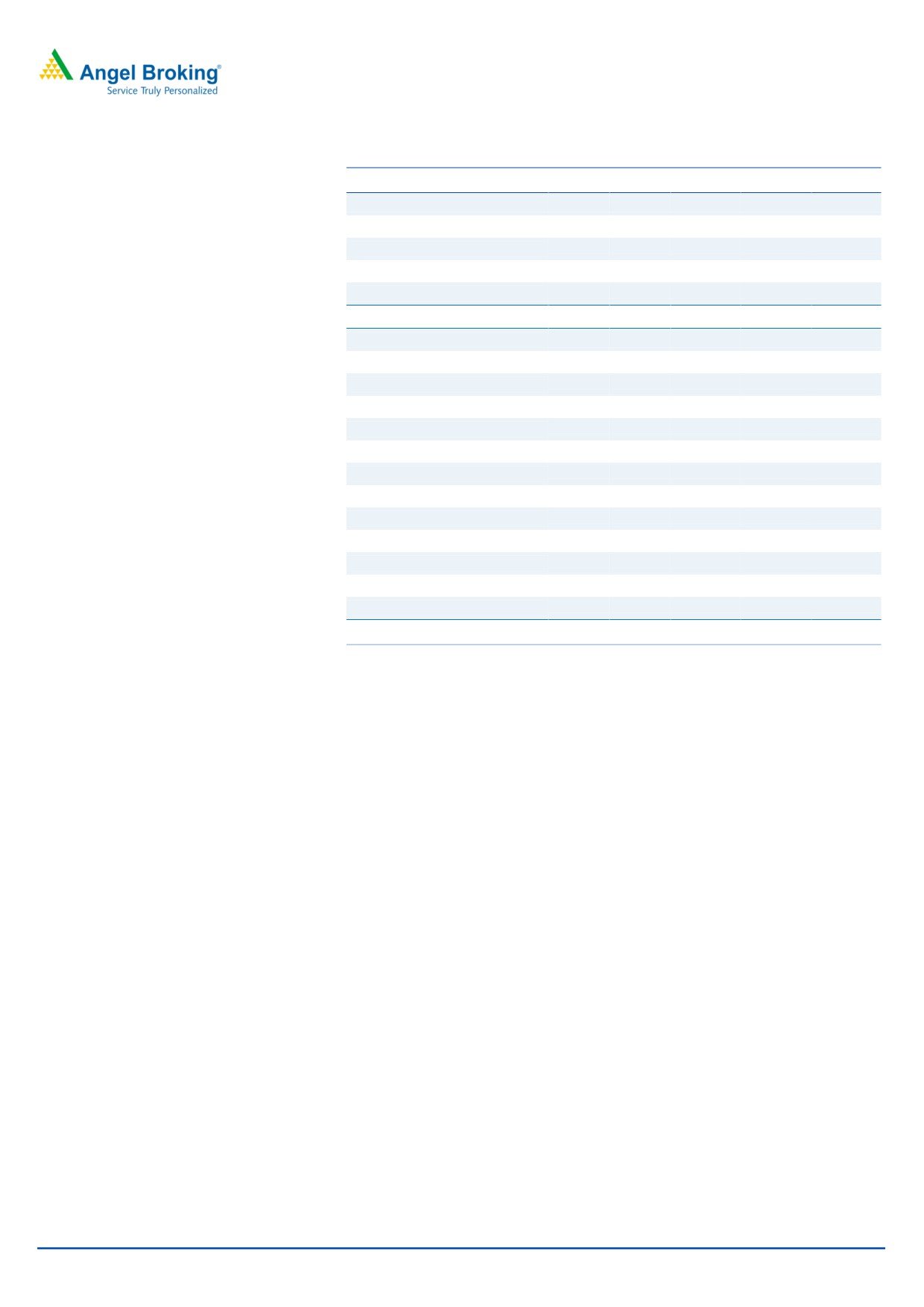

Balance Sheet

Y/E March (` cr)

FY2016

FY2017

FY2018

FY2019E FY2020E

SOURCES OF FUNDS

Equity Share Capital

42

57

57

57

57

Reserves& Surplus

168

491

543

593

650

Shareholders Funds

210

548

600

650

707

236

168

54

34

24

Total Loans

446

717

653

683

731

Total Liabilities

APPLICATION OF FUNDS

Net Block

230

312

297

328

305

Capital Work-in-Progress

66

0

0

0

0

15

27

156

156

156

Investments

Current Assets

113

385

208

213

287

Inventories

0

0

0

0

0

Sundry Debtors

22

33

22

27

30

Cash

16

280

76

77

135

0

0

0

0

0

Loans & Advances

Other Assets

21

23

22

26

30

Current liabilities

44

45

45

51

54

Net Current Assets

69

340

163

162

233

Other Non-Current Asset

66

38

37

37

37

Total Assets

446

717

653

683

731

January 31, 2019

5

Music Broadcast Ltd| 3QFY2019 Result Update

Consolidated Cashflow Statement

Y/E March (` cr)

FY2016 FY2017 FY2018 FY2019E FY2020E

Profit before tax

56

57

75

93

108

Depreciation

17

20

26

27

28

Change in Working Capital

11

21

(26)

3

(13)

Interest / Dividend (Net)

19

19

15

5

5

Direct taxes paid

(11)

(20)

(24)

(31)

(36)

Others

(26)

-

-

-

-

Cash Flow from Operations

66

97

67

97

92

(Inc.)/ Dec. in Fixed Assets

(286)

(35)

(20)

(50)

(5)

(Inc.)/ Dec. in Investments

217

(12)

(129)

-

-

Cash Flow from Investing

(69)

(47)

(149)

(50)

(5)

Issue of Equity

-

303

(2)

-

-

Inc./(Dec.) in loans

83

(123)

-

(20)

(10)

Others

(111)

38

(128)

(17)

(19)

Cash Flow from Financing

(28)

218

(130)

(37)

(29)

Inc./(Dec.) in Cash

(31)

268

(212)

10

58

Opening Cash balances

43

13

280

68

77

Closing Cash balances

13

280

68

77

135

January 31, 2019

6

Music Broadcast Ltd| 3QFY2019 Result Update

Key Ratio

Y/E March

FY2016

FY2017

FY2018

FY2019E FY2020E

Valuation Ratio (x)

P/E (on FDEPS)

61.3

47.0

32.3

26.8

23.2

P/CEPS

38.0

30.3

21.4

18.7

16.6

P/BV

8.0

3.0

2.8

2.6

2.4

Dividend yield (%)

0.0

0.0

0.0

0.7

0.9

EV/Sales

6.2

5.2

4.7

4.2

3.8

EV/EBITDA

17.9

15.3

14.4

12.4

10.9

EV / Total Assets

3.1

2.0

2.1

2.0

1.9

Per Share Data (Rs)

EPS (Basic)

4.8

6.2

9.1

10.9

12.6

EPS (fully diluted)

4.8

6.2

9.1

10.9

12.6

Cash EPS

7.7

9.7

13.7

15.6

17.6

DPS

0.0

0.0

0.0

2.2

2.5

Book Value

36.8

96.1

105.1

113.9

124.0

Returns (%)

ROCE

16.0

10.1

10.9

12.6

13.8

Angel ROIC (Pre-tax)

17.5

17.5

16.8

19.1

22.9

ROE

13.0

6.5

8.6

9.6

10.2

Turnover ratios (x)

Inventory / Sales (days)

-

-

-

-

-

Receivables (days)

123

110

135

120

120

Payables (days)

36

44

27

30

30

Working capital cycle (ex-cash) (days)

87

66

108

90

90

January 31, 2019

7

Music Broadcast Ltd| 3QFY2019 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager and Investment Adviser with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking

Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration

number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for

accessing /dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed

public offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While

Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.

Disclosure of Interest Statement

Music Broadcast

1. Financial interest of research analyst or Angel or his Associate or his relative

No

2. Ownership of 1% or more of the stock by research analyst or Angel or associates or relatives

No

3. Served as an officer, director or employee of the company covered under Research

No

4. Broking relationship with company covered under Research

No

Ratings (Returns):

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

Reduce (-5% to -15%)

Sell (< -15%)

January 31, 2019

8